HEALTH INSURANCE – THE LONG & THE SHORT OF IT…

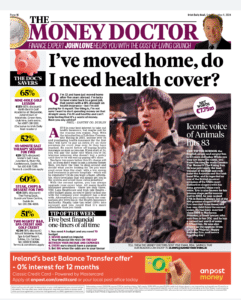

Q. I’m 32 and have just moved home after 5 years abroad. I’m lucky to have come back to a good job, that comes with a 10% discount on health insurance – but still paying for it myself. The thing is, I’m not sure I want to start spending money on that straight away. I’m fit and healthy and can’t help feeling that it’s a waste of money. Any advice? Paul – Santry Co Dublin

A. It’s in your best interest to take out health insurance, but maybe not for the reasons you realise Paul. With the introduction of Lifetime Community Rating in 2015, anyone over 34 and purchasing health insurance for the first time will have to pay an extra 2% on their premium for every year over 34 they have reached. So you’re better off buying health insurance as soon as you can – if you start at 34, you will pay the same rate when you’re 54; whereas someone who doesn’t buy a policy until they turn 54 will end up paying 40% more. You have two years before this 2% charge will hit, so if you don’t want to join a scheme before then, you at least have the time to shop around and decide what you’re looking for. Do you want good cover from the start, with a low excess and treatment in private hospitals – which will be expensive? Or do you want a basic, affordable, entry-level plan, that will simply get you in the system and avoid those extra penalties? With the second option, you can always opt to upgrade your cover at a later stage. All major health insurance providers – there are only 3.. VHI, Laya Healthcare and Irish Life Health – offer budget plans, so you’re likely to find one with the company your employer has a deal with. Alternatively you could check comparison site www.hia.ie the Health Insurance Authority. Finally, take tax relief (20%) into account and you could find it’s more affordable than you think.

( 342 words)