As the festive season approaches, many Irish wine enthusiast investors maybe considering which wines to add to their collections. Whether you’re a seasoned investor or a novice looking to start, choosing the right wines can be a rewarding endeavour. John Lowe of MoneyDoctors.ie explores some of the better wine investments tailored for the Irish market, focusing on their potential for both enjoyment and financial appreciation.

Bear in mind wine investment should be just one of the many alternative investments in a well balanced investment portfolio. Recently given a tour of the K Club in Co Kildare wine cellar by sommelier Lisa O’Doherty, it really was an eye opener and certainly would instil an interest in this asset class. Lisa showed me her most expensive bottle – a Romanée Conti 1995 burgundy for sale at € 40,000. I was able to inform her that had that bottle been 50 years older, the cellar would possess the most expensive bottle of wine ever bought at an auction…$ 558,000 ! But here are some of the more inexpensive options…

- Bordeaux Wines: Timeless Classics

Bordeaux remains a cornerstone of fine wine investment, and for good reason. The region’s reputation for producing age-worthy wines makes it a safe bet for collectors. In particular, look for wines from top estates like Château Margaux, Château Lafite Rothschild, and Château Latour. These wines not only hold their value but often appreciate significantly over time.

Investment Tip: Opt for recent exceptional vintages such as 2015, 2016, or the highly acclaimed 2018. These years have been praised for their quality and aging potential, making them prime candidates for long-term investment.

- Burgundy: Elegance and Rarity

Burgundy wines, especially those from renowned producers in the Côte d’Or, are known for their finesse and complexity. The limited production and high demand for top-tier Burgundies create a perfect storm for investment potential. Wines from producers like Domaine de la Romanée-Conti, Armand Rousseau, and Domaine Leroy are particularly sought after.

Investment Tip: Given the small production quantities, acquiring these wines can be challenging. Consider purchasing en primeur (wine futures) to secure allocations of coveted vintages before they hit the market.

- Champagne: Sparkling Investments

Champagne is not only a festive favourite but also a smart investment choice. Vintage Champagnes from prestigious houses such as Dom Pérignon, Krug, and Louis Roederer (particularly Cristal) have shown impressive price appreciation over the years. The growing trend of aging Champagne adds to its investment appeal.

Investment Tip: Focus on vintage years and special cuvées. Look for recently released vintages that have received critical acclaim, as well as older, well-preserved bottles that can fetch high prices at auction.

- Italian Icons: Barolo and Super Tuscans

Italy offers a treasure trove of investment-worthy wines, with Barolo and Super Tuscans leading the charge. Barolo, often referred to as the “King of Wines,” is renowned for its longevity and depth. Producers like Giacomo Conterno and Bruno Giacosa produce highly collectible wines.

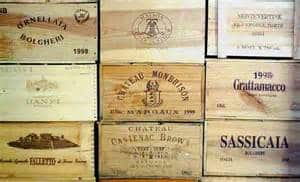

Super Tuscans, a category born out of innovative winemaking in Tuscany, combine traditional Italian grapes with international varieties. Sassicaia, Ornellaia, and Tignanello are standout names that command high prices on the secondary market.

Investment Tip: Look for critically acclaimed vintages and limited production runs. Italian wines often offer excellent value compared to their French counterparts, making them an attractive option for diversification.

- Emerging Regions: New Horizons

While traditional wine regions offer security, emerging regions provide opportunities for adventurous investors. Wines from Spain’s Priorat, Portugal’s Douro Valley, and even the burgeoning quality of Californian and Australian wines are gaining traction. These regions are producing high-quality wines that are starting to be recognised on the global stage.

Investment Tip: Research and identify top producers and vintages that are receiving high scores from critics. Investing early in these regions can yield significant returns as their reputation grows.

Practical Tips for Wine Investment

- Storage: Proper storage is crucial. Invest in a professional wine storage solution to maintain optimal conditions.

- Provenance: Ensure the wine’s provenance is impeccable. Buy from reputable merchants or directly from wineries to avoid counterfeits.

- Market Trends: Keep an eye on market trends and expert analyses. Publications like Decanter and Wine Spectator provide valuable insights.

- Diversification: Just like any investment portfolio, diversification is key. Spread your investments across different regions and producers to mitigate risks.

Investing in wine can be both a delightful and profitable venture, especially during the festive season. For Irish wine enthusiasts, focusing on a mix of established classics and emerging gems can yield a rewarding collection. As you enjoy the warmth and cheer of Christmas, consider these wine investments not just for their potential returns, but for the joy and sophistication they bring to your holiday celebrations. If the investment doesn’t work out, you can always drink the asset ! Cheers …