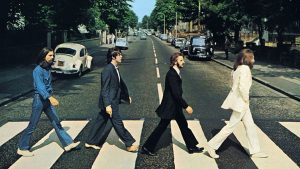

If you are looking for an asset that is going to provide you with a great deal of enjoyment, some juicy tax savings and – crucially – the potential of a substantial capital gain then it is hard to beat the benefits offered by investing in a classic car. There is a classic car in the above Beatle photo ( to find out, you’ll have to scroll through the article, so you may as well read it ! )

Classic cars have shown a steady increase in value for two reasons. Firstly, like rock memorabilia or watches, they are in sufficient demand to have gained acceptance by auction houses and other sellers keen for new business. Whilst not exactly a liquid asset, there are plenty of ways to buy and sell a classic car, quickly and inexpensively.

Secondly, but perhaps more importantly, this demand is not limited to a select few. In the two major classic car markets – Europe and the US – there are no shortage of affluent buyers who grew up in an era when the car defined the culture. They may not have been able to afford the car of their dreams in the 1950s, 1960s or 1970s – but they can afford it now, albeit tempered by the current recession. An Aston Martin V8 can still be found for under €20,000 or a Ferrari 308 GTB for under €30,000.

So, how do you choose a classic car that will bring you both pleasure and profit? Obviously you need to pick a car that you like the look of and will enjoy driving. For a car to be considered a classic it is usually at least 25 years old. This said, from an investment perspective there are cars that may be less than a decade old – such as the Dodge Viper, Jaguar XJ220 and XJR-15 or Bugatti EB-110 – which are already considered future classics. So age should not be your primary consideration from an investment perspective. What should be your primary consideration are the different factors which make one car worth more than another. These include:

– The manufacturer. A Morris or an Austin – no matter how good – will never have the same allure to buyers as a Ferrari or a Bugatti.

– The model. A mass-produced, family car will never be worth as much as something with rarity value. Even low-production cars – such as Bentleys – will vary wildly in value. A 1980s saloon can be had for €15,000 but a 1920s racer might cost you over a million euro.

– Cultural zeitgeist. The cultural status of a car can have a major effect on its value. If the car wasn’t highly desirable when it was launched it is unlikely to ever become highly desirable.

– Provenance. A car with a history – for instance, a car that has won an important race or been owned by someone famous – will always be more collectible.

– Condition. The more original and better the condition, the more likely it will appreciate.

– The price. Up to around €60,000 the market is dominated by enthusiasts rather than collectors. That is not to say with a bit of careful research you won’t be able to identify an undiscovered classic, but the more you invest the lower the risk.

Are there any downsides? Classic cars are not passive investments. You can’t tuck them away in a bank and forget about them. They need maintenance, garaging and regular servicing by a specialist to keep them in tip top shape. Remember, too, that prices can fluctuate. In the early 1990s the price of an E-type Jaguar fell from its all time high of €150,000 to €60,000.

Which cars have produced the best returns? Competition cars and high performance cars seem to be the most secure long term bet with competition cars from the 1970s and 1980s perhaps offering the best scope for gain at present. Other recommendations might include something like a Jaguar XK series (XK120, XK140 and XK150) which can be had for as little as €40,000 or possibly an Aston Martin DB5 for around €80,000. If you are on a tighter budget (bearing in mind the greater risk) the Audi Quattro, BMW 2002, Citroen DS, Jaguar E-type (despite its previous fall from grace), and Volvo P1800 all look interesting.

Did you notice a classic car in the Beatle photo ? Only last year, I had the opportunity to buy a car from the iconic photograph of Abbey Road, the Beatles album No it was nt the cream VW beetle beside the last Beatle to walk the zebra crossing (George Harrison) – the second line on the number plate 29 IF..started a rumour that Paul McCartney was dead and he would have been 29 years old if he had lived ! No it was the car 40 yards further up on the same side as that VW beetle – a 1967 Triumph Herald estate light blue car bought by a Dublin classic car dealer David Golding ( www.automatics.ie ) for £2,500. He then set about proving the provenance and sold it for four times what he paid to a Los Angeles based American comedian who gave it to his manager. That manager wasted no time and placed the car in an LA Beatle festival where it was reported he made $88,000 in one week just from charging a fee for photographs etc. Robert Palmer once sang some guys have all the luck…

The photo below incidently was sold on 22nd May 2012 for £16,000 ( € 20,512 ) at an auction – there were only 6 photos taken that morning of 6th August 1969 by photographer Iain Macmillan – you can imagine what the album photo is worth.